In crowded markets, specialists win

Welcome to the Sociology of Business. In my last analysis, The Case of Hermès, I explored how Hermès focus on the fundamentals made it dethrone LVMH as the most valuable luxury company. If you are on the Substack, join the chat. With one of the paid subscription options, join Paid Membership Chat, and with the free subscription, join The General Chat on The Sociology of Business WhatsApp group.

Bernard Arnault is the master of hype.

For the past decade, Arnault has been hiring creative directors and shepherding collaborations that were sure to generate maximum global attention. 2017 alone has been named the year of the hype and, true to its name, it was when Louis Vuitton brought Jeff Koons bag back and became friends with Supreme after years of litigation. In 2018, Virgil Abloh joined Louis Vuitton Men and Kim Jones joined Dior Men, ushering the new streetwear-luxury era of much-coveted drops. From there, things sped up, pandemic notwithstanding. The latest hype has been this winter’s reissue of the Murakami bag. A few months ago, there was a line for it in Louis Vuitton’s SoHo store.

In contrast, Hermès hasn’t created a single new hit in 42 years, since the launch of its Birkin bag. The brand is still riding on Birkin’s halo. But Hermès recently overtook LVMH as the most valuable luxury company. In the context of the luxury industry’s growth, this is meaningful: in 2003, global sales of personal luxury goods reached $400bn, up from $100bn in 2000, according to Bain. But during 2024, this growth has reversed, and the value of the ten most valuable luxury companies fell by more than a tenth.

Hype versus halo is a matter of strategy.

Hype means creating intense publicity and promotion meant to spur excitement and anticipation around a brand’s products or services. It is a preferred strategy across culture industries, from entertainment to food, music, art, design, fashion and luxury to consumer packaged goods and travel.

Hype originated in the streetwear culture, where limited-edition drops created social and cultural capital around scarcity and were the language of the subculture. Supreme was known for its Thursday 11am drops of a precious few new products, a strategy borrowed from Japanese streetwear culture. Fashion brands followed, with Moncler Genius making collaborations a backbone of its brand strategy and many LVMH and Kering brands riding on the wave of collaborations as a way to drive hype and sales of its more affordable products, like sneakers, t-shirts, sweatshirts, and accessories.

But hype and sales don’t always go together.

VF Corp sold Supreme at a loss in 2024 to EssilorLuxottica. What once was a genuine way to generate social and cultural capital, signal scarcity, create FOMO, and drive sales, led to consumer fatigue.

For hype to work, a brand needs to be strong.

Hype around Miu Miu’s crystal panties and its boat shoes is sustained by everything else that this brand does: its’ book pop-ups, its constantly fresh Lotta Volkova styling, the scarcity of items and sizing in its stores, the creativity of its advertising, the septuagenarian on its social media, the halo of its runway. Miu Miu comparative sales doubled in the first three quarters of 2024.

In contrast, when a brand keeps releasing TikTok videos that garner hundreds of thousands of views, but whose retail environment is overcrowded with product, visual merchandising is poor, items are always 40% off, and advertising is printed on cheap material, hype does not translate to sales: it is wasted in the present and leads to diminishing returns on consumer attention in the future.

For hype to work, a product needs to be strong.

Hype creates anticipation for a product or service, unavoidably inflating their value and desirability. Products have to either be of a higher quality than a brand’s usual offering or they should be new: a limited edition, a capsule, accompanied by merch, or done in a collaboration. They also need to be scarce – made in limited quantities and/or distributed in limited locations.

For hype to work, consumers need to want to wait in line. Gen Z often does. There has been much talk how stores and restaurants artificially limit occupancy in order to create lines and mimic hype, but Gen Z also often considers waiting the main event. Waiting for food turns it into an experience.

Like hanging out in queues, hype eventually becomes an activity in itself.

For companies, this is dangerous. The hype’s means — constant media coverage, CEO’s LinkedIn posts, and PR noise — can easily be mistaken for its end: the stable and sustainable sales. Hype is often a motive in itself; a costly, constantly hungry machine.

To prevent hype from wearing off, brands need to combine it with halo.

Halo effect refers to positive perceptions of a brand image, its reputation for innovation, product quality, or retail experience influencing consumers’ overall perception of the entire brand.

This positive perception has in past often been achieved through advertising, but in the past decades, brand halo is achieved through convenience and functionality of all brand’s retail touchpoints, from the website to the app and physical retail experience and service, to brands’ social media to its cultural products, like collaborations, merch, packaging, content, events, creative partnerships, brand codes and aesthetics, archive reissues, and product portfolios.

Apple created its brand halo with iPod. The company marketed it as its main product. As iPod cost a fraction of iMac and MacBook, it was widely adopted, creating a much wider customer base for Apple. iPod carried perception of brand popularity and innovativeness into iPhone, AirPods, and all other Apple products and services for the past twenty years.

Today, Apple is coasting on iPod’s halo. Once a reliable creator of hype, the brand now makes money on incremental innovation and customer lock-in with the halo at its core. (Apple recently experienced excitement akin the old days, when thousands of consumers rushed to its stores to load up on Apple products before tariff-induced price hikes).

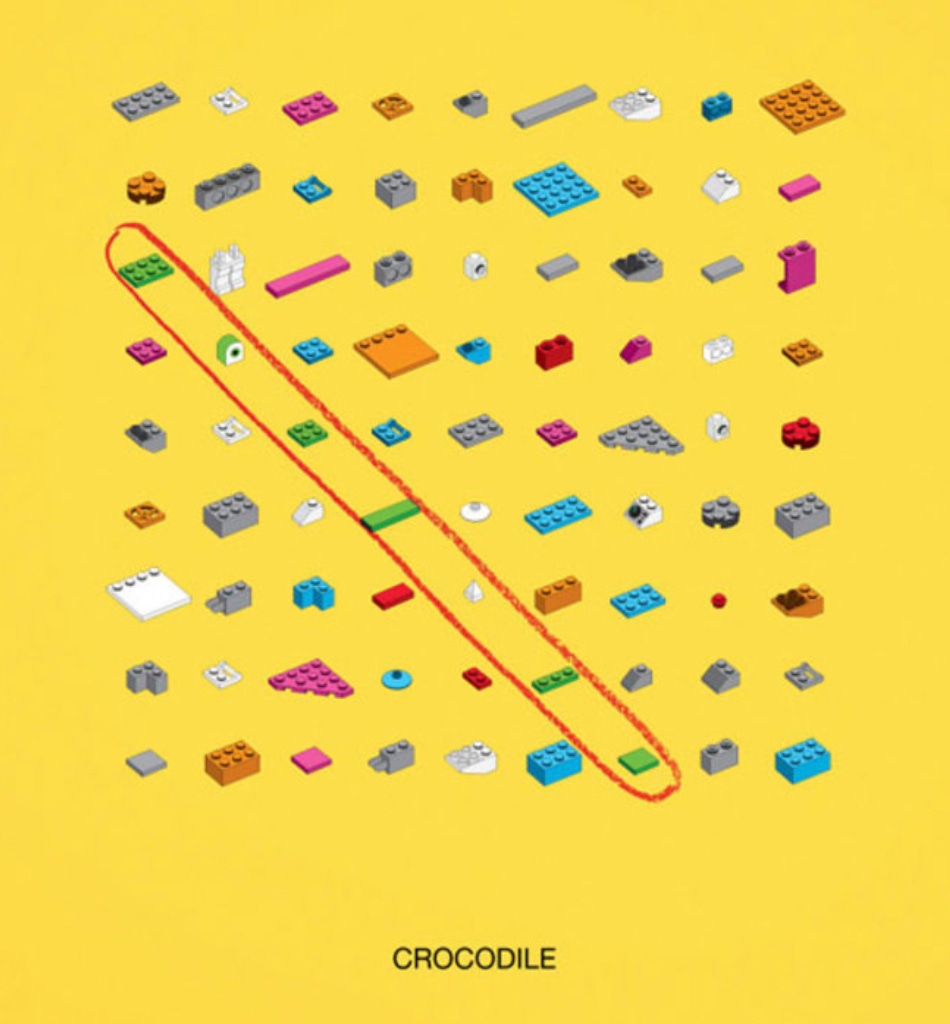

Lego is the world’s biggest toy brand. This hasn’t always been the case: in the early 2000’s, the company was in trouble, a result of it trying to do everything: clothes, watches, TV shows, theme parks. All these hype-making ideas generated more products, and in return, more distractions. The new CEO made the company remember its halo: brick sets. Instead of chasing the latest opportunity, Lego innovated by doing less but better. Lego has since collaborated with Star Wars and Harry Potter, and extended its market to adults. The brand creates hype today in a controlled and strategic manner – through a timed release of its movies and video games, its collectible sets, its special editions, and by nurturing a strong community of fans.

Nike has long enjoyed the halo of product innovativeness and the hype of cultural relevance. In 1984, Nike created Air Jordans, to the massive original hype and $100mn in sales in the first year. Since then, it turned this hype into durable brand halo. In the past decade, however, this brand halo diminished, with brands like On and Hoka starting to be perceived as more innovative, and brands like Asics and New Balance as more hype-worthy. Nike lost both halo and hype at the same time, and its sales cratered as a result.

In contrast, Hermès Birkin halo has, thanks to its aversion to overexposure, only strengthened in the past forty years. The bag is today a cultural genre unto itself, lending demand to Hermès ready-to-wear, accessories, beauty, perfume, and jewelry. Hermès also immediately elevates neighborhoods it opens its stores in, and its whimsical brand world confidently lives everywhere from websites to advertising to airport stores to pop-ups. The hype comes from halo, and is driven by the passion of the brand fans, not manufactured by marketing.

Hype is a spark that ignites a brand halo (if Jane Birkin wasn’t already such a legend and if the bag origin story was not so serendipitous, the Birkin would not have reached the level of myth that it enjoys today). But without halo, hype burns into Fyre.

Ultimately, brands that create halo are specialist brands. They know they don’t need to be the best at everything. They are the best in one area of their business, and are synonymous with it, and its halo helps them expand the rest of their categories forward.