I’m excited to announce a new collaboration with Whatnot, the largest live shopping platform in North America and Europe. Over the next several months, Whatnot will contribute new data to The New Consumer about what’s working in the fast-growing live commerce market.

Live shopping — e-commerce via live video streams, generally in smartphone apps — is finally getting big in the US, around a decade after taking off in China.

On platforms like Whatnot, every minute of the day, consumers are buying items like sports cards, handbags, electronics, beauty products, and even food from live sellers, who act as expert guides, entertainers, and community leaders. It’s a “content to commerce” model that’s actually scaling — something that eluded earlier attempts by Meta, Amazon, and others.

For a sense of size, the live shopping market reached around $22 billion in North America and Europe last year, Whatnot estimates in its new State of Live Selling Report, more than doubling over the previous year. (In China, it’s approaching $1 trillion, representing an estimated 60% of the e-commerce market there.) Whatnot alone generated over $8 billion in live sales last year, more than doubling year over year. You can download Whatnot’s full report here.

On Thanksgiving Day, while many Americans were watching football, I was tuned into Whatnot. In The Collector Crew channel, more than 500 viewers gathered concurrently to watch as users bid on sports cards auctions — one of Whatnot’s earliest categories — including an Aaron Rodgers rookie card. “This is the most quality I’ve ever had in a show,” the host said. “Let’s make history today.”

“People are coming in, finding community, and geeking out on products,” says Armand Wilson, Whatnot’s VP of Categories and Expansion — a longtime employee responsible for growing the platform beyond its collectibles roots.

“They’re definitely transacting as well,” Wilson says. Whatnot shoppers spend a lot of time in the app — 95 minutes per day, globally, according to the State of Live Selling report — and often make multiple purchases per week.

Whatnot’s sellers are individual entrepreneurs and small business owners, typically organized around a category, like sports cards, sneakers and streetwear, women’s fashion, and electronics. Many start as solo operators; some have scaled into the hundreds of millions of dollars in GMV. One in eight now works selling full-time on Whatnot, up 20% from 2024, the company says.

The growth can be dramatic. A Boca Raton card shop says it went from $40,000 in monthly revenue into the millions after adding live selling to its business model, and expanded from two to 39 employees. But most remain small businesses at heart: 99% of sellers on Whatnot have fewer than 50 employees, according to a recent poll.

What drives success? Just like offline, top live sellers have to put great stores together, featuring interesting and unique merchandise, either offered as auctions — these are very fast on Whatnot, at times lasting just seconds — or in larger lots.

Successful sellers tend to be passionate hosts who know how to build fandom, suspense, hype, and intrigue.

Many sports card sellers use segments called “breaks,” where hosts open packs of sports cards live on the air, with the possibility of unearthing super-rare cards worth millions of dollars. Fresh produce sellers have gone live from the farm, picking fruit that they then ship across the country. For some fashion and jewelry sellers, live shows provide the opportunity to demonstrate different customization options, like colors, textures, and hardware.

Those sellers, at their best, build genuine communities, attracting people who want to hang out in an environment tuned to their interests, whether it’s makeup or Legos. Shoppers often join for the products and then stay for that connection (and the entertainment).

Top sellers are also consistent: US sellers who go live daily generate $69,000 per month in sales, on average, according to Whatnot; that’s around 20 times the sales of those who go live once per week.

And while sports cards and trading card games still lead in volume, the fastest growth is coming from lifestyle categories: Beauty sales grew nearly 800% last year, electronics more than 400%, and jewelry and women’s fashion each more than 200%, according to Whatnot’s report. Wilson is eyeing food and drinks as a big category for 2026; he’d someday like to get into the automotive auction game.

Zooming out, the recent success of live shopping in the US reflects the intersection of multiple trends: A generational shift toward digital-native culture and community; social video as a particularly compelling medium to promote and sell products; the transfer of attention share toward individual creators and away from legacy media brands; and growing interest in entrepreneurship via the creator economy.

Each of these continues to grow, and each is concentrated among younger generations — the shoppers and business owners of the future. (More in the Consumer Trends 2026 report I recently published with Coefficient Capital.)

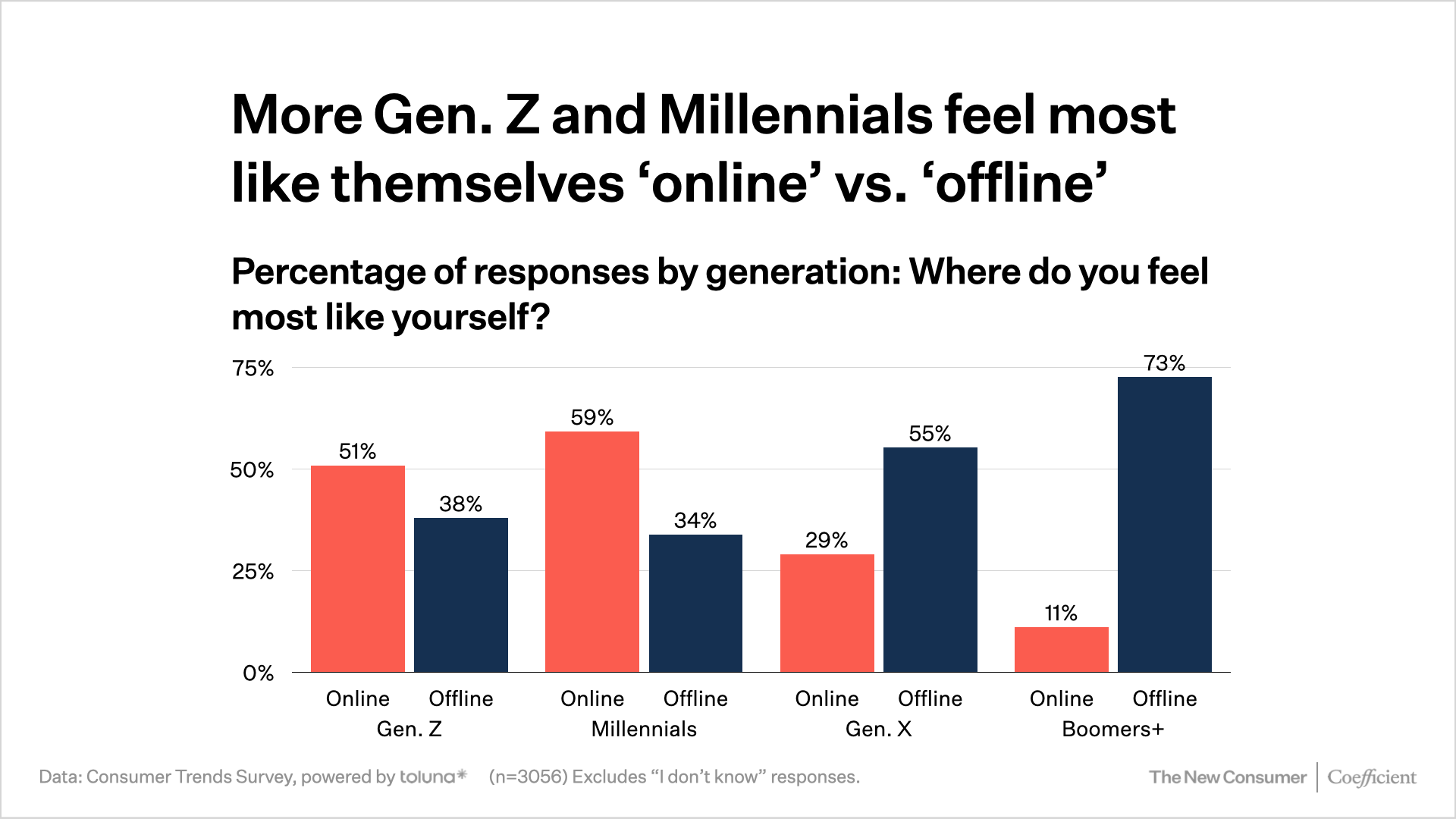

For instance, in our latest Consumer Trends Survey of more than 3,000 US consumers, more than half of Gen. Z and Millennials — 55% — said they felt most like themselves “online” versus “offline.” A greater portion of Gen. Z and Millennials, 62%, said they felt most connected to others “online.” This was even higher — 77% — among our respondents, across all age groups, who said they used Whatnot at least monthly.

Meanwhile, in our survey, 45% of Gen. Z and Millennials said they consider themselves a “content creator,” whether as a profession, as a hobby, or for fun.

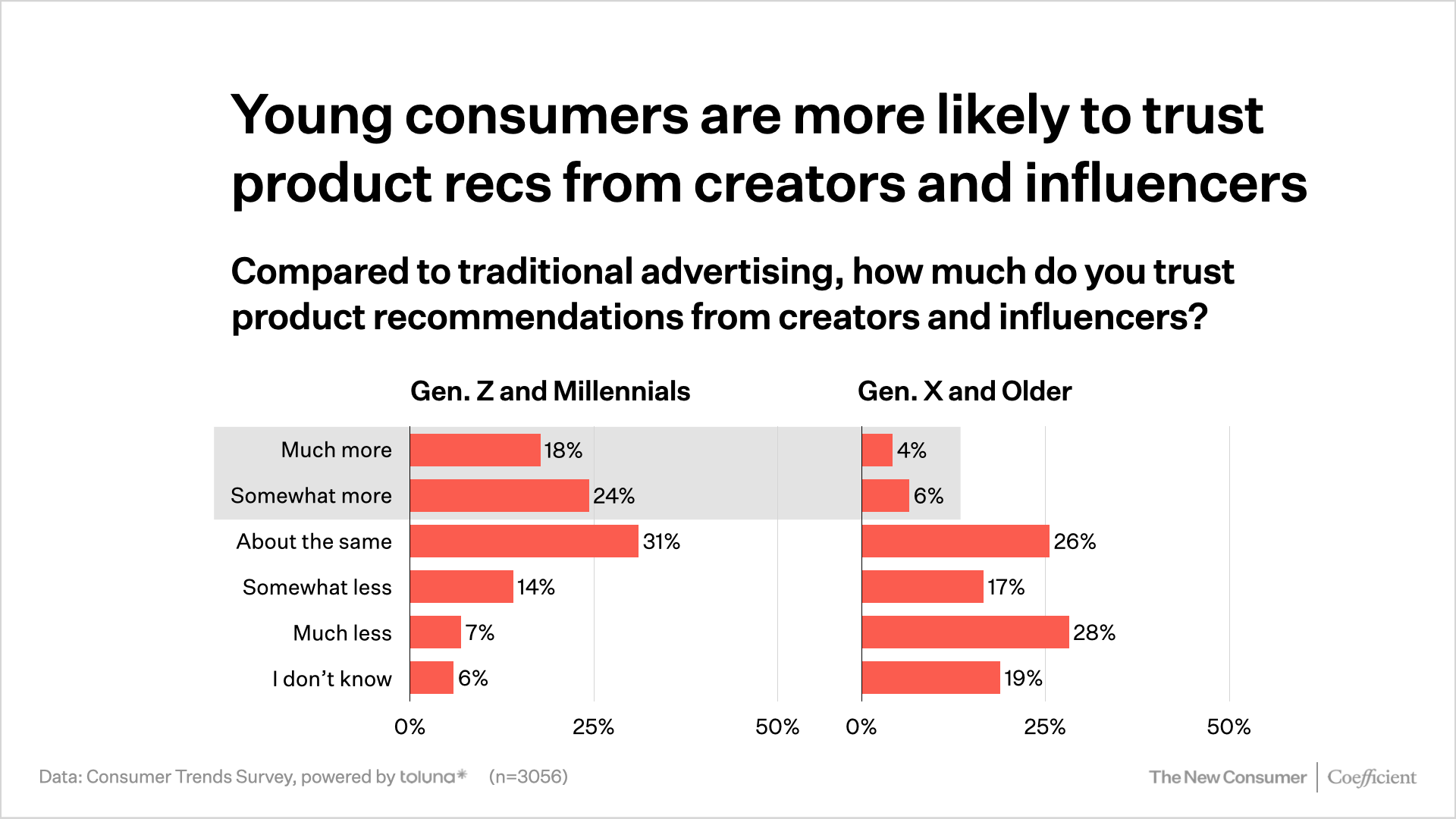

And creators have credibility among many young consumers: 42% of Gen. Z and Millennials in our poll said they trust product recommendations from content creators or social media influencers “much more” or “somewhat more” than from traditional advertising.

Younger Americans also tend to value entrepreneurship more than older generations. When we asked our survey panel to choose among a list of things that are important to their definition of success, twice the proportion of Gen. Z and Millennials selected “Owning your own business / working for yourself” as those Gen. X and older.

So it’s no surprise that young entrepreneurs are looking to social commerce platforms to build businesses online.

On Whatnot, many new sellers are coming from a retail or sales background, Wilson tells me; it helps to have experience selling products and a pipeline for obtaining inventory. But now that live shopping marketplaces can reach a critical mass of customers, they can be compelling complements or alternatives to other types of stores, both online and offline.

“If you’re really into comic books and you buy a bunch of products, sign a lease, decorate the store, build it all up, whatever that investment may cost… And you compare that to opening up a Whatnot account… You can get way more foot traffic than if you’d just opened up a shop in your town,” Wilson says.

You also don’t need to be in a huge city to build a successful business online. On Whatnot, Florida’s suburban corridor — Boca Raton, Delray Beach, Largo — generates more GMV relative to population than major metros, the company says. Mid-sized cities like Rochester, Dayton, and Raleigh “out-earn Los Angeles and Chicago on a per-resident basis,” according to the report.

Live shopping’s US success is still far from replicating China’s trajectory — the markets differ in mobile commerce maturity, social platform integration, and consumer habits. But it’s finally working here, as both buyers and sellers spend more time on live shopping marketplaces.

“We think there’s a part of Whatnot that’s expanding the pie of sellers,” Wilson says, “and giving more access to folks that may not have the capital you need to open a big brick-and-mortar store.”

Stay tuned to The New Consumer for more data and trends from the live shopping market over the coming months.

Hi, I’m Dan Frommer and this is The New Consumer, a publication about how and why people spend their time and money.

I’m a longtime tech and business journalist, and I’m excited to focus my attention on how technology continues to profoundly change how things are created, experienced, bought, and sold. The New Consumer is supported primarily by your membership — join now to receive my reporting, analysis, and commentary directly in your inbox, via my member-exclusive Executive Briefing. Thanks in advance.